What Is The Best Bank For Amazon FBA?

If you’ve decided that you want to start running your own Amazon FBA business or any kind of business, then regardless of whether you’re going down the sole trader or limited company route, you’re going to need to get a business bank account. Establishing a relationship with banks for your Amazon FBA business is one of the important steps I took, as it allowed me to keep my personal and business affairs completely separate, which not only saved me a tonne of headaches but also my accountants. As for me, Osome has been the most helpful accounting service I have used in my Amazon FBA business. Here’s a link if you want to see it for yourself at a discounted price. In this blog post, I’ll enumerate my recommended banks for Amazon FBA sellers.

In this day and age, we’re really spoilt for choice when it comes to business bank accounts, but that doesn’t mean that you should rush out and apply to the first bank that you come across because some banks are much much worse than others and should be avoided where possible, if you don’t want to pull all of your hair out in a fit of rage.

As someone that’s created multiple businesses over the past 5 years, I’ve done my fair share of business bank account applications, and I’ve developed a pretty good understanding of the type of banks that are good for new small business owners and the ones that aren’t so accommodating.

In this article, I’m going to be running through the 3 different banks that I’ve used and recommend that you check out, along with the different considerations that you should take into account before choosing which is right for you. I’ll also cover some tips to help you with the application process.

One thing to take into account is that when it comes to business bank accounts, you’re not limited to just one. In fact, I’ve got 2 banks for Amazon FBA that I use for different purposes – one for storing funds and making deposits and one paying suppliers in USD. While some people prefer to just stick with the one business account for simplicity, there’s no rule when it comes to how many you’re allowed.

Although, obviously, it’s probably best to not overdo it for the sake of your accountant’s sanity. If you like the look of more than one the business accounts that I recommend in this article, there’s nothing stopping you from applying for both.

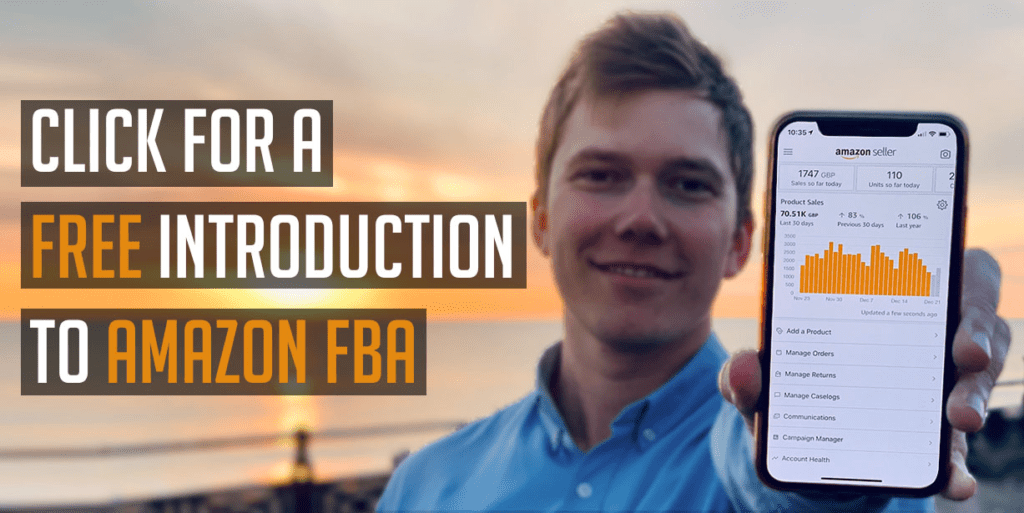

Best Amazon FBA Bank Account: Tide (free £50 credit when you join)

The second business bank account I recommend is with a digital bank named Tide. Tide is a relatively new kid on the block and only recently started to get the attention that it deserves.

In terms of the application process, Tide’s is very swift and efficient, and I was accepted within just a few days of applying without any issues at all. During your application, you may be asked to provide details about your business – and I’ll run through how to answer those questions at the end of this article. If you’re an Amazon FBA seller and wondering whether Tide accounts can be used you’re your account, the good news is, that, yes, as of 2023, they can.

As a digital bank, Tide has an entirely online presence, so there are no high street branches for you to be able to visit. The upside of that though is that they have much lower overheads than the likes of Lloyds, HSBC, and so on. Because of that, they’re able to invest heavily into their app and tech offering. The phone app is lightyears ahead of any high street bank that I’ve used. You can raise invoices for your customers, apply tags and comments to any expenses that you’ve made which is great for accounting purposes, and loads more. You can also make foreign exchange payments to overseas suppliers for a small charge, and with the cashback account, get 0.5% of your expenditure reimbursed to you every single month.

If you’re interested and sign up here and get £50 credited to your Tide account as soon as you make a £50 deposit.

Best High Street Bank: Lloyds Bank

When I created my first business back in 2018, I wanted a business account with a bank that had a presence on the high street, just for that extra peace of mind. I already had a personal banking relationship with Lloyds, so I decided to apply for an account with them. Opening a business banking account with a high street bank that you already have a personal relationship with is definitely going to speed up the application process versus going with a bank that’s never heard of you.

The verification checks are incredibly quick, and in my experience, I was able to get a bank account setup in just 4 days, which really helped to keep the momentum going in the early days of running my business. If you have any questions about the application process or your account when it has been created, you’ve got the flexibility to be able to go into a branch, call up, or chat online, which is great for that extra peace of mind if you’re the type of person that does like to worry.

Since opening that account with Lloyds in 2018, I’ve stuck with them as my main business bank, even though after 12 months of using them they do start to charge an account fee of £7 a month. It’s not a huge amount and even though the other banking options that I’m going to be running through don’t have a monthly fee, I’m probably still not going to switch banks just because of their UK presence.

High street business bank accounts work pretty similarly to most personal bank accounts that you’ll have come across, so they come with debit cards with good fraud prevention, the ability to do bank transfers, and so on. However, where they do fall short is on the tech side. Their app is limited in functionality, foreign exchange transfers are slow, unintuitive and expensive, and there are rarely any benefits that you’ll get as a result of your spending. That’s why I have business accounts with other banks, in order to make up for those shortcomings and get the best of both worlds.

Best For Paying Suppliers: Wise (fee free transfers for first £500)

The final business account that I recommend and use is Wise, formerly known as TransferWise. Now, wise slightly differs from the other two options because it’s not classed as a bank, but an e-money institution, which means that from a regulatory point of view, your funds don’t have the same level of protection that a bank would offer in the event that it went bust. But, with that said, Wise is a multi-billion pound company that is regulated by the FCA, so it still safeguards your funds in a completely separate account to its own.

The application process with Wise is the quick and easy, and you can have GBP, USD, and EUR accounts set up and running within 20 minutes. There is a small setup charge if you want to get a debit card, and whilst it’s a bit of annoyance to pay up front, in my view, it’s completely worth it for the savings that you’ll get when making overseas transfers. Paying foreign suppliers is the exact reason that I setup a Wise account in 2018, and it’s still my preferred route to do that. The rate that I’m offered is typically aligned to what you’ll find on Google, and payments are made on the SWIFT network which are usually received the same or next day. The app’s functionality is fantastic and keeps you updated on the whereabouts of your money at all times for extra piece of mind. Recently, they’ve even started offering you the ability to buy stocks, shares and crypto. Unfortunately, at the moment though, there’s no option to get cashback or other perks on your spending.

You can join Wise and get £500 of fee free transfers by registering here.

Amazon FBA Bank Application Process Tips

Once you’ve decided which business account or accounts you want to get, you’ll need to start the application process where you’ll be asked to provide your company name and incorporation number, as well as your personal details, including proof of identity and address – all pretty standard stuff that you should have to hand.

Most banks, with the exception of Wise, will then usually ask you to explain the purpose of your business, your expected revenue, as well as details of your supplier. With questions like these and any that are similar, try to keep your answers as broad and high level as possible. Say things like, “We are an e-commerce business that is aims to sell products within the home category on platforms such as Amazon, sourced from a supplier in China. We expect to achieve revenues of £50,000 in our first year of trading.“

You may be asked to provide additional supporting documents about your business, which you can usually source from your accountant, HMRC, or a company that you’ve recently made a business purchase from.

Some banks, such as Starling, have been known to reject applications because their robot doesn’t like the answers its being given, so if that happens to you, go with one of my recommendations instead, and if it’s still happening, try to source the email of the support team so that you can circumvent the robotic application process and explain that you’re a start business that hasn’t actually started trading yet. If you can try and communicate this to a person rather than via the automated application form, your chances of getting a quick approval will be heightened considerably.

In summary, here are the 3 business bank accounts that I use across the businesses that I run:

- Lloyds, a high street bank that I like to have for peace of mine

- Tide, a free digital account that comes with lots of great perks – including £50 for free if you use this link

- Wise, which I use to pay all of my suppliers

When you’ve got your business bank account sorted, you can now begin selling with Amazon. Read how I quickly made £50,000 in a month with Amazon FBA.

If you want to learn how you can create an Amazon FBA business yourself, then check out my free training where I’ll teach you everything you need to launch your first product on Amazon and scale to $5,000+ in monthly profit.

Or if you’re ready to begin your journey and want to start with the best chances of success, apply to become a member of HonestFBA’s training programme where you’ll receive guidance & support from our team of 7-figure Amazon FBA seller experts whenever you need it.