Understanding Taxation and Financial Planning in the UK

If you’re based in the UK and have at least one form of income, then a question that you’ve probably asked yourself at some point in the past is, “Why am I paying so much tax?”

In a bid to reduce the country’s huge deficit, over the past number of years, the government has steadily increased tax rates which has been a bitter pill to swallow, especially in light of the general cost of living in the UK becoming more and more expensive.

So, in times like these, it’s crucial that you act smart and use whatever legal means in the form of allowances and reliefs to pay less tax in the UK. Understanding ways to increase your wealth by reducing your tax bill is a challenge to many. In fact, its estimated that the majority of people across the UK don’t make full use of their tax allowances and exemptions, and as a result around £12.6 billiom of extra taxes are paid each year.

As someone that has faced huge 6-figure tax bills from the tax man before, I’ve done my fair share of research into the different allowances that we get each year to reduce what we owe, the most relevant of which I’m going to be running through with you now.

With the top bracket of income tax currently sitting at 45%, tax is likely to be the biggest expense that you’ll ever pay throughout your lives, so learning how to reduce this bill is the easiest way to make your money go further. Before I cover the different ways that you can legally reduce the tax that you owe on your income, let’s run through how your tax bill is actually calculated in the first place, which will help with your understanding of how reliefs and allowances help you out.

How Tax Works In The UK

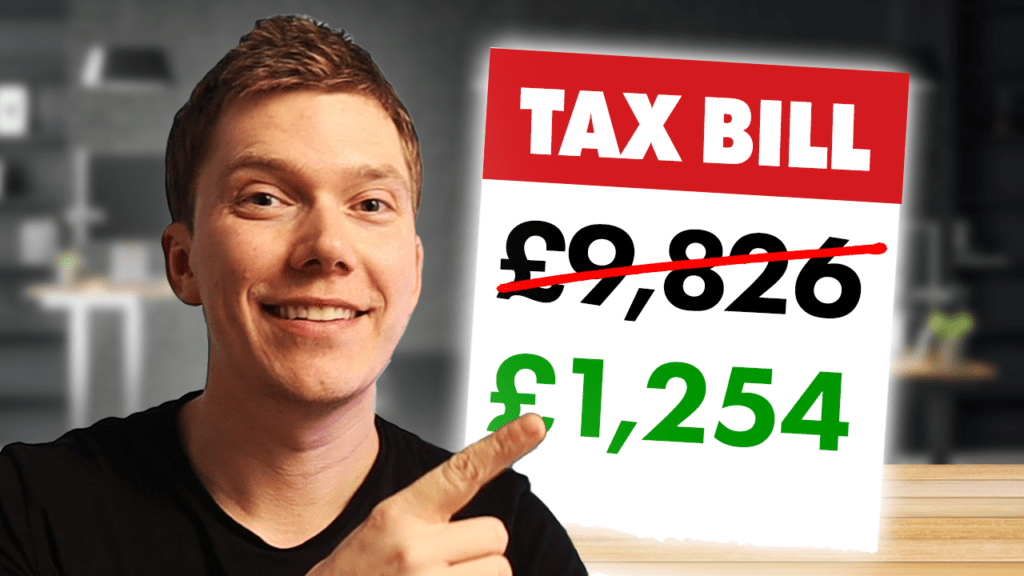

Within the UK, every single person that earns income – which includes a salary, bonus, rental income or a pension – pays nothing on their first £12,570 of annual earnings –and income tax on anything above that, with the effective tax rate that you pay set according to the amount that you’re getting paid and the number of tax brackets that the size of your salary falls into.

The UK uses a bracketed tax system, with different tax rates applying to each bracket: basic rate – 20%, higher rate – 40%, and additional rate – 45%

A common misconception that people have about tax is that as soon as your earnings reaches the size of the next bracket up, you’ll pay a higher rate of tax on your entire income, so you’ll actually be earning less than before. This isn’t true because the UK’s tax system is a progressive one, meaning that if you get a pay rise to earn £60,000, you’ll still continue to be charged 20% tax on your earnings up to £50,270 – with just the remaining £10,000 or so attracting the higher tax rate of 40%.

So, if you’ve been offered a pay rise at work that’s going to put you into the higher rate 40% tax bracket, and you’re questioning whether your net earnings will actually go down because you’re now paying a higher rate – remember, it’s only the income that sits above the basic rate tax bracket – which is currently £50,270 where you’ll pay 40%, and the income that sits above the higher rate bracket – which is £150,000, where you’ll pay 45%.

Now, if your income is higher than £100k a year, then there is a nuances to the effective tax rate that you’ll pay because for every £2 you earn above, this amount you’ll lose £1 of your £12.5k personal but that’s not going to impact the majority of the guidance that I’m sharing with you today, so we’ll save diving into the detail of that for another day.

Now that you understand that the UK’s tax system is a progressive one that uses tax brackets, let’s run through the different ways that you can reduce the amount of tax that you pay.

Pay Into A Pension

For pretty much all of my 20s, I couldn’t think of anything more boring than pensions. I viewed them as something that only old people should care about, and because of that, I never bothered to learn what they actually were, which meant that I missed out on years of tax savings. Don’t make the same mistake that I did and spend a moment now listening to what a pension is and why it’s so beneficial to save into.

In its simplest terms, a pension is just like a savings account that you deposit into, with the only difference being that you can’t touch those savings until you retire from work, which is likely to be in your 60s. Every employer in the UK has to offer and arrange a workplace pension for you by law, with the amount that you choose to save into that pension each month deducted from your pay check before any taxes have been applied.

Iif you earn £50,000 a year and tell your employer that you want to contribute 10% of your earnings into your pension, then at least £5,000 will be put into your savings account and won’t be taxed. Over the years that £5,000 and any other contributions that you make is going to hopefully grow substantially because it’s not just sitting as cash in your pension bank account. Instead, it’s invested into stocks and shares and managed by an investment manager. Once you retire, you can pay yourself 25% of whatever is in your pension completely tax free.

To make this deal even sweeter, most employers will match or even beat whatever you contribute into your pension each month, again at no tax cost to you. That’s why deciding to contribute 10% of your salary each year is not only going increase your effective earnings by the amount of tax that you would’ve paid on that 10% but also by the amount that your employer contributes to your pension as a result of its match scheme.

The downside of course to pensions is that you can’t touch the money until you’re at least 55, but it’s still well worth doing because its free money and you’re helping to secure your quality of life when you’re older by contributing a relatively small amount today.

If you are self employed or have your own business, then don’t worry. You’re not going to be left out when it comes to pension benefits because any contribution that you make through your company is an allowable expenses, i.e., you won’t pay any tax on whatever you decide to put into your pension. Speaking of having your own business, that leads me onto my next tip for reducing your liability – creating your own company.

Company Structure

If you run own business or you have a side hustle or you’re thinking of having one, then one of the easiest ways to reduce how much tax you pay is to run that business or side hustle through a company. Every business that I own – so my Amazon FBA business, my coaching business, my youtube business and so on – each of those are operated through limited companies because of the tax allowances and reliefs that are given to companies over individuals.

As a company, you’re able to deduct business related expenses from your income, which reduces the tax that you owe. For me, expenditure on items such as my camera, computer, and even a portion of my electricity and heating bills, are all used to lower my tax bill. Additional business-related expenses that are permitted include lease costs from renting a car, fuel costs, and courses and private coaching from a mentor.

Provided that the expense was incurred for the purposes of running your business, it should be allowed. If you’re unsure or what additional guidance on what it and isn’t permitted to be used when lowering your tax bill – speak with your accountant, my recommendation is Osome who are a digital accountancy firm. If you’d like to get in touch with them, click here.

Another huge advantage of operating your business or side hustle as a company, is the actual tax rate that is applied to your profits, which after all said and done is lower than if you just operated as an individual. In the UK, business’s pay a rate of 19% on their profits after all expenses and if you want to then withdraw the profits from the company to spend on your personal affairs via a dividend, you’ll get the first £1,000 tax free. Then if you’re a basic rate tax payer, you’ll pay just 8.75% of dividend tax, which compares to 20% income tax and 13.8% national insurance contributions if you are an individual.

If you want to run a business or you already have one, do it through a limited company – your future self will thank you.

Tax Wrappers

In the UK, one of the easiest to ways to pay less tax and even get free money from the government is by putting any savings that you have into a special type of savings account known as an Individual Savings Account or an ISA.

An ISA is essentially an investment account that can you save up to £20,000 a year into, which is shielded from any tax charges whatsoever. If your ISA balance increases in size, whether that be due to interest payments on your cash or if dividend payments or capital growth if you’re invested in stocks and shares, then you won’t pay a penny in taxes. So, if you manage to say £20,000 into an ISA that pays 5% interest, after a year you’ll have made £1,000 worth of tax free interest income. Awesome, right?

To encourage young people to save into ISAs, the government currently also offers something known as a Lifetime ISA – or LISA, which has a £4,000 annual limit and comes with a 25% cashback bonus for free. So if you save £4,000 a year, at the end of each year, you’ll automatically be given an additional £1,000 tax free on top of any interest or dividend payments earnt. The only condition to getting this annual bonus, is that you can’t withdraw any of the money from your LISA until you’re buying your first house OR until you retire at 60.

Regardless of which option you go for though, the LISA is well worth getting in addition to an ISA. Over time, if you can keep making use of the £4,000 annual allowance, you can get up to £32,000 of free cash in addition to an unlimited amount of tax savings.

My recommendations for an ISA is with Trading 212, which allows you to buy shares and invest in funds with zero commission, and for the LISA with Hargreaves Lansdown.

Conclusion

Every single person in the UK probably agrees that they pay too much tax, and whilst tax rates have been steadily increasing for a number of years, fortunately there are still a number of ways to reduce the amount of tax that we pay. Do your own research into the methods that I’ve run through today and see how many you can apply to reduce your tax bill as much as possible.

In relation to this post, I also have some recommendations on the best Amazon FBA accounting and bookkeeping tools.

If you want to learn how you can create an Amazon FBA business yourself, then check out my free training where I’ll teach you everything you need to launch your first product on Amazon and scale to $5,000+ in monthly profit.

Or if you’re ready to begin your journey and want to start with the best chances of success, apply to become a member of HonestFBA’s training programme where you’ll receive guidance & support from our team of 7-figure Amazon FBA seller experts whenever you need it.