Do These Before Paying Off Your Mortgage

If you’re a homeowner in the UK, then thanks to the ongoing increase in interest rates, you’ve probably questioned whether you should be looking to pay off as much of your mortgage as possible using all of your savings or any extra money that’s left from your monthly pay check after all of your bills and expenses.

On the one hand, paying off your mortgage early means that you’re likely to feel like a burden has been lifted – especially if it’s a large one, giving you a nice psychological benefit and ultimately giving you more flexibility about how frequently you need to work or can afford to do nice things. But on the other, a mortgage is the cheapest loan that you’ll probably ever have in your life, and therefore making overpayments in order to pay it off should rank pretty far down in the list of where you allocate your spending.

Whilst there are strong arguments for and against paying off your mortgage early, the “right decision” is going to boil down to your own personal circumstances and where you are in life financially speaking, which you can understand after going through a number of steps in sequence.

Step 1: Create A Budget

Before you can make any decision about whether you should be over paying on your mortgage, you need to make sure that you’ve got a good understanding of what’s coming in the door each month and what’s going out. And to do that – you need to make a budget, and you need to make a sensible one. There’s no point putting together a budget that predicts you’ll save 90% of your income each month because you’ll be eating baked beans every day, only drinking water, and going for a walk for fun. It’s not realistic and it’ll only distort any decisions that you make about what to do with your excess income.

Be sensible when planning out how much you’re likely to be making, spending and saving each month. Look at the expenditure that you’ve made in the past, and determine whether the same outgoings are likely to be made in the future. Sure, if you feel like you’ve been overindulging on expensive meals out, subscriptions that you don’t need and so on, then make cutbacks, but don’t go so extreme that you wreck your social life and don’t allow yourself to have any fun.

When putting your budget together, above all, don’t forget to include all of the essential items that you’re responsible for paying – mortgage payments, council tax, utility bills, transport and so on – everything needs to be included so that you can properly assess what your excess income is and understand where to allocate it.

Step 2: Save Enough For An Emergency Fund

Once you’ve put together a sensible budget that covers all of your income and expenditure for the next year, if it’s likely that you’re going to have an amount of money left over at the end each of month, then before making any decision about whether you should be using that cash to overpay on your mortgage, my advice is to first ensure that you’ve got an instantly accessible emergency fund that is big enough to cover at least 1-2 months worth of outgoings.

Having a nest egg or rainy day fund in this day and age is pretty essential in my view – not just to cover a worst case scenario in the event that you lose your job or main source of income, but also to serve as a back-up in the event of an unexpected but sizeable expense, which is something that you won’t be able to afford to pay for if you’ve used all of your excess cash to pay off your mortgage instead. Having a nest-egg that covers a couple of months worth of your outgoings is also likely to give you a nice psychological benefit and help reduce any stress and anxiety if you work in an job that’s high pressured or has a high proportion of its income paid as commission.

Step 3: Pay Off High Interest Debt

If you’re comfortable with the size of your emergency fund, then the next step to consider when deciding whether you should be overpaying on your mortgage, is whether there’s any other expensive debt that you have that you can be paying off first. Credit cards, car loans, personal loans and so on – all of these come with much higher interest costs and fees than mortgages do, and therefore, in 99.9% of cases, it’s going to make way more sense to overpay on this type of debt than it is on any mortgage. The problem with short term high interest debt such as credit cards is that the interest costs are so astronomically high, that even if you make payments on time, you’re still paying a huge proportion of your income on interest charges, which massively restricts how much you’re able to save at the end of each month.

So if you have any credit cards or outstanding debt that is incurring a high amount of interest – so a rate of more than 8%, then this should be your first priority when it comes to any excess income that you have at the end of each month.

Once you’ve cleared any high interest or short term debt that’s outstanding, you might be thinking – okay, now I can start overpaying my mortgage… well, in my opinion, not quite yet. And that’s because of the p word. Pensions! Yes, it is an incredibly boring topic that you associate with old people, but it’s an important one.

Step 4: Pay Into Your Pension

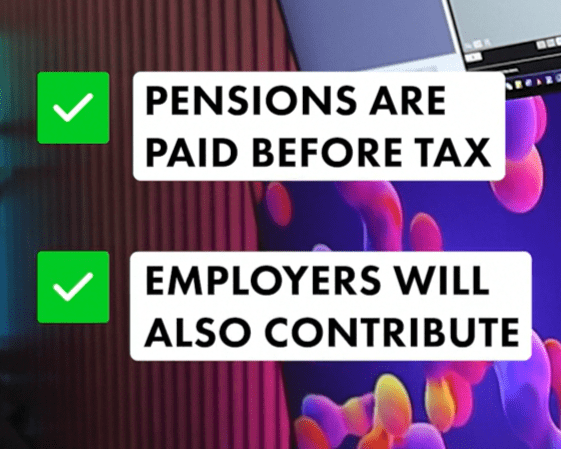

Every employer in the UK has to offer and arrange a workplace pension for you by law, and the amount that you save into that pension each month is deducted from your pay check before any taxes have been applied. It’s not mandatory for you to pay into a pension, but there are a lot of benefits if you do, with the main ones being that whatever is paid from your salary into your pension account is done so before tax, and, whatever you contribute into your pension, your employer will typically match that or at least pay in a sizeable proportion alongside your contribution – so extra money, that isn’t taxed, entirely for free.

Now the downside to having a pension is that you can’t access the money in it until you retire, but having one helps to secure your future, and the money that’s being saved, isn’t just sat in a low paying interest account, but its likely being invested on your behalf and grown at a higher rate than any mortgage rate that you’re currently paying – especially if you factor in the free money that you’re getting from your employer as a result of you contributing.

In terms of how much you should contribute to your pension – it’s really going to come down to the size of your disposable income each month, but ultimately, if you can aim for an amount that results in your employer’s contribution maxing out – which for a lot of places is around 5%, then you’ll be in a good place.

At this point, if you find that after you’ve built your emergency fund, paid off any high interest debt and contributed to your pension, you’ve still got cash left over, then firstly – well done, a lot of people don’t consistently reach this position at the end of each month, so you’re certainly in the minority. This is the stage where you can finally start to consider whether you want to be making excess payments in an attempt to pay off your mortgage. And I say consider, because depending on your risk appetite, you may still think it doesn’t make sense from a returns standpoint to start paying off the cheapest piece of debt that you’ll ever incur.

Step 5: Consider Saving / Investing If You Have A Low Cost Mortgage

If you’re one of the lucky few that manage to re-mortgage last year on a fixed rate deal before interest rates started rising, your mortgage is probably costing you under 3% in interest each year. Therefore, if you decide to use your spare cash to pay off your mortgage, you’re effectively only saving 3%, which is a lower rate of return than you’d be able to get in interest payments through many bank accounts. And if you’re comfortable investing in the financial markets, that 3% saving is going to look even more unattractive because of the high returns on offer.

For example, if you’d have started putting your savings in to the S&P 500 5 years ago rather than paying off your mortgage, you’d be sitting on a pretty sizeable sum right now. In fact, if you’d have invested in the S&P 500 since its inception, the average yearly return that you’d have enjoyed would have been just under 10%, pretty nice indeed . But with that said, investing in the markets is a long term game and of course gains aren’t guaranteed – and that’s exactly why at this stage, deciding whether to invest or overpay on your mortgage is going to come down to your level of risk tolerance, especially if you weren’t able to benefit from a mortgage deal when interest rates were low, or your fixed term deal is shortly due to come to an end.

If you’d like to know more about investing, read my blog on How To Invest Your First £100, a step-by-step investing guide for beginners.

Step 6: Reduce Your LTV & Consider Investing The Remainder

If you are at this final stage and you’re considering how much of your savings – if any – to invest, and how much – if any – to overpay on your mortgage, than you could take a leaf from my book, which was to look at how much of an overpayment would be needed to bring my Loan To Value down so that I benefitted from an interest rate cut. Most mortgage providers tier the interest rate that you pay according to your Loan To Value %, so the size of the loan as a proportion of the house’s value. The lower the LTV, the lower your interest rate will be when you next come to re-mortgage . So if you’re in two minds about whether you should invest or pay off your mortgage, my advice is look up your current LTV and see how much you’d need to pay off in order to reduce it and benefit from a lower interest rate.

Taking that approach means that you can benefit from paying off some of your mortgage so that you benefit financials, whilst also giving you the flexibility to invest some of your cash into products that will give you a higher return than repaying the entirety of your mortgage.

Of course, there’s always going to be the argument that paying off your mortgage first gives you the huge psychological benefit of knowing that you own your home no matter what happens, which may be worth forgoing the bigger financial returns on investing into the financial markets, but that’s an entirely personal matter and comes down to your own risk tolerance. Without a doubt though, before you even state to consider whether you want to overpay on your mortgage, make sure that you’ve put together a budget, you’ve paid off any high interest debt, and you’re utilising your pension in order to benefit from numerous tax breaks and extra free money from your employer.

If you’ve got your own view on whether you should be paying off your mortgage before anything else, let me know in the comments.